06/2016 420 thousand new cars and only 3 thousand hybrids? TNS survey

During the Poznań Motor Show press days, we ventured to ask representatives of the automotive sector and the associated media about their forecasts for the market’s development in 2016. Our respondents turned out to be somewhat less optimistic concerning market growth than some of the analysts. Still, the forecasts based on our respondents’ opinions seem to be highly realistic.

380 thousand new passenger cars in 2016

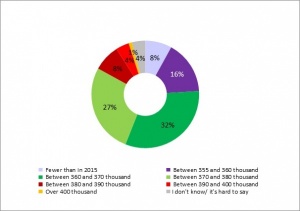

As much as 83 percent of representatives of the automotive sector visiting this year’s Poznan exhibition estimated that new passenger car sales are not going to exceed 380 thousand this year. Is the industry more pessimistic than analysts tend to be? In April, market analysts forecasted a result of approx. 390 cars by the end of the year, increasing the prognosis presented following March by 10 thousand cars. Coram-Research’s forecasts, in their report on 60 markets (including Poland), estimated this year’s new passenger cars sales volume at 422 thousand. However, this is an excessively optimistic prognosis, as it would indicate a market growth of 19% year on year, which is not very realistic.

Q: What sales volume do you expect at the turn of 2016?

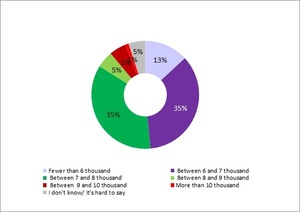

Slightly over 5.5 thousand hybrid-power cars were registered in Poland last year. These were primarily Toyota vehicles. This year, the Polish Toyota and Lexus representative has an ambitious plan to increase the sales of both brands’ hybrid cars. Are they going to succeed in repeating last year’s result? The vast majority (83%) of the sector representatives who participated in the study conducted at the Poznań Motor Show believed that this year’s hybrid car sales would not exceed 8 thousand. If sales of new hybrid-powered cars actually revolve around the 8 thousand mark, the market is going to grow by approx. 45%.

Q: How many hybrid vehicles will be sold in Poland in 2016 in your opinion?

No faith in private customers

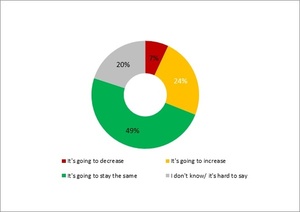

The market is dominated by institutional clients, and sector representatives do not believe that the share of private customers in new car sales is going to rise in 2016. A quarter of our respondents expressed the opinion that the share of companies in new car registrations is going to remain the same, with as many as half (49%) believing that the said share is going to grow. Although the company car market seems to be saturated, it still has potential, at least our respondents seem to believe so. New vehicle financing forms based on high residual value (the so-called HRV lease and credit), and the general economic climate foster company purchase growth. Obviously, these factors affect the private customer’s market as well, though to a much lesser extent.

Do you believe that the share of companies in the purchase of new cars is going to decrease, increase, or stay the same in 2016?